Bitcoin: Be Your Own Bank

Bitcoin: Be Your Own BankYou may have heard of Operation Choke Point over the last year in reference to payday lending, and more recently in reference to firearm sales and porn star personal accounts. The gist of it is this: The Department of Justice (DOJ) is strongly encouraging banks and third party payment processors to close the accounts of individuals and businesses associated with certain high-risk merchant categories such as payday/online lending, firearms/ammunition sales, and pornography, and even dating services. Essentially, the DOJ has tasked banks and third party payment processors, such as PayPal, with “choking” out specific industries by slowly but continually constricting their access to financial services.

CCN

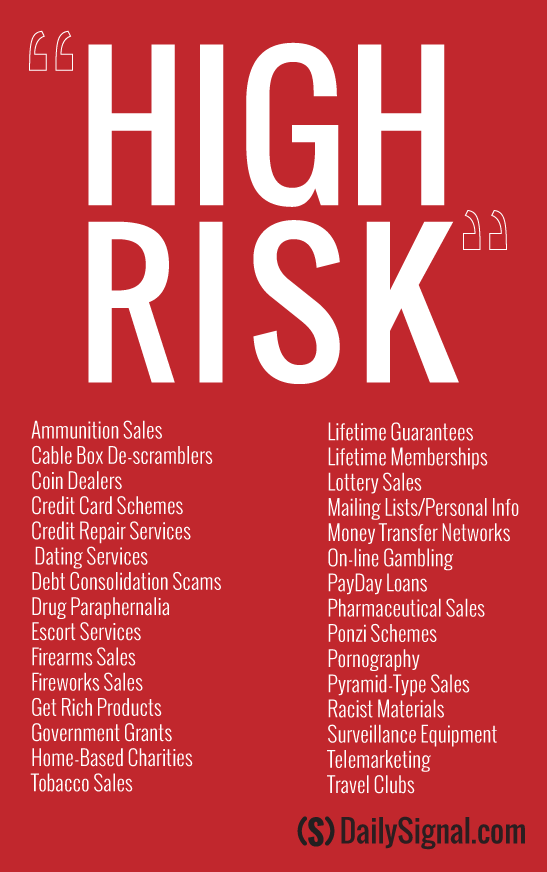

According to The Hill, the DOJ encourages banks and third party payment processors to drop these high-risk clients by “flooding payments companies that provide processing service to those industries with subpoenas, civil investigative demands, and other burdensome and costly legal demands.” The American Banker reveals, in their timeline of Operation Choke Point, that the subpoena flood started shortly after Operation Choke Point’s inception in March 2013. The subpoenas went to banks and payment processors large and small: Everything from the $343 million-endowed National Bank of California to the $220 billion-endowed PNC Financial Services Group. By fall of 2013, the Justice Department had pressured some banks into settling with the government. The DOJ used these settlements as a template to further strongarm other banks into compliance. The DOJ is targeting 30 high-risk industries, as labeled by the Federal Deposit Insurance Corporation (FDIC) in 2011, in a report titled “Managing Risks in Third-Party Payment Processor Relationships.”

The FDIC’s list of 30 high-risk merchant categories that are currently being pursued by the DOJ.

- Ammunition Sales

- Cable Box De-scramblers

- Coin Dealers

- Credit Card Schemes

- Credit Repair Services

- Dating Services

- Debt Consolidation Scams

- Drug Paraphernalia

- Escort Services

- Firearms Sales

- Fireworks Sales

- Get Rich Products

- Government Grants

- Home-Based Charities

- Life-Time Guarantees

- Life-Time Memberships

- Lottery Sales

- Mailing Lists/Personal Info

- Money Transfer Networks

- On-line Gambling

- PayDay Loans

- Pharmaceutical Sales

- Ponzi Schemes

- Pornography

- Pyramid-Type Sales

- Racist Materials

- Surveillance Equipment

- Telemarketing

- Tobacco Sales

- Travel Clubs

Payday and Online Lenders

In America, most of the mainstream media has been focused on Operation Choke Point’s attempt to gag and bind the payday loan industry, which is legal in 36 states and certainly no Saint to the Bitcoin community. New York Financial Services Superintendent Benjamin Lawsky also made choking actions in his own state, where four of the nation’s largest banks reside, when he instructed New York banks to be wary of unlicensed online lenders and cracked down on licensed lenders that were violating New York’s own interest-rate cap. On the topic of edging payday lenders out of his state, Lawsky had this to say: “We want to make payday lending into New York, over the Internet, as unappetizing as possible.” When announcing New York’s acceptance of Bit-License applications, Lawsky had this to say: “…the fact is that virtual currencies are unlikely to disappear entirely. They will likely continue to exist in one form or another. As such, turning a blind eye and failing to put in place guardrails for virtual currency firms while consumers use that product is simply not a tenable strategy for regulators. Our overarching goal is to balance creating appropriate regulatory protections without stifling beneficial innovation in the development of new payments platforms.” Bitcoin is certainly capable of being used in newly developed payment platforms that won’t have any trouble staying under New York’s interest-rate cap. On the topic of Bitcoin and loans, BTCJam has recently moved to the United States.

Guns and Drugs

Bitpay previously shut down the account of Central Texas Gun Works because bitpay’s ToS specifically bans gun sales and gun services. It is unclear whether or not bitpay enforces this ban because their bank requires it, or for other reasons. Infamous marketplace Silk Road also bans firearms and ammunition sales, though for ideological reasons. CoinVoice now provides the Bitcoin payment processing for Central Texas Gun Works; on the other side of the country, Coinbase also allows gun stores to accept Bitcoin with their merchant services. Info Wars reports that banks such as Bank of America have also denied firearm related businesses without any substantiated or legal reasoning in connection with Operation Choke Point. One budding industry that is not mentioned by the FDIC or targeted by Operation Choke Point is none other than the marijuana industry, which has been choked out of financial systems since its inception and is now starting to embrace Bitcoin. However, Coinbase and bitpay have both expressed their unwillingness to work with legal marijuana distributors. Likewise, drug paraphernalia sellers that accept Bitcoin are doing so without banks or third party payment processors (in this case, Bitcoin payment processors) because they have long since been choked out of the financial system, despite their technically legal offerings. As you can see, Bitcoin payment processors also feel the pressure from Operation Choke Point.

Porn and Dating Services

More recently, reports have started to circulate regarding porn stars having their personal bank accounts closed. The most recent article from Al Jazeera reveals that PayPal, along with Chase, has also been inexplicably shutting down the accounts of porn stars. Furthermore, PayPal has been tight-lipped on the reason for these account closures, and Operation Choke Point hasn’t been explicitly mentioned, at least by Al Jazeera. Porn stars first started reporting to the media that their personal accounts were being closed in early 2013 with Xbiz reporting that hundreds of porn stars have been affected. The DOJ doesn’t have to worry about bitpay and firearm/ammunition sales; however, bitpay has proven to be an incredible ally to the porn industry and has led Bitcoin’s charge into the high chargeback industry. Porn.com and now Verotel both accept Bitcoin using bitpay; both are able to charge lower fees without the risk of chargeback. OKCupid has been using Bitcoin for over a year now… Almost as long as the DOJ has been unintentionally pushing these industries towards Bitcoin. Every industry in the world can benefit from Bitcoin Blockchain technology; it’s just that these 30 have been given a forceful push by the government.

Image from nybe.

Updated: May 7, 2014 at 2:01 pm CET.

bitcoin industriesdepartment of justiceoperation choke point

Reply With Quote

Reply With Quote

Bookmarks