Nope.

This Is What A $12 Trillion Dollar Margin Call Looks Like

by Tyler Durden

Wed, 03/18/2020 - 16:00

TwitterFacebookRedditEmailPrint

'Mystery Chart' time...

No, it's not Volkswagen, or even Tesla.

This is the world's reserve currency soaring to an all-time record high...

00:16 / 03:11

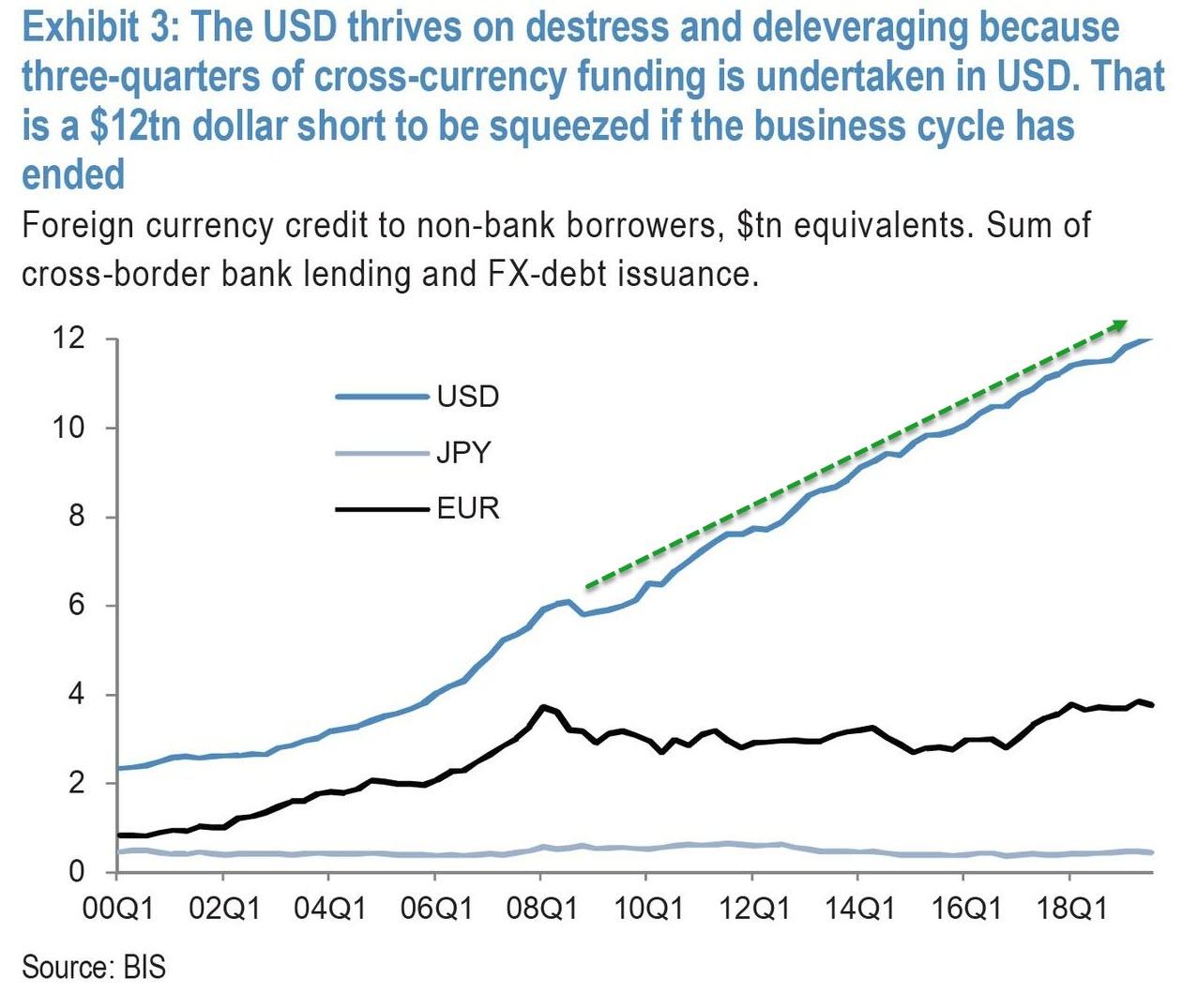

..and this is what happens when a global margin call reveals there is a $12 trillion short squeeze.

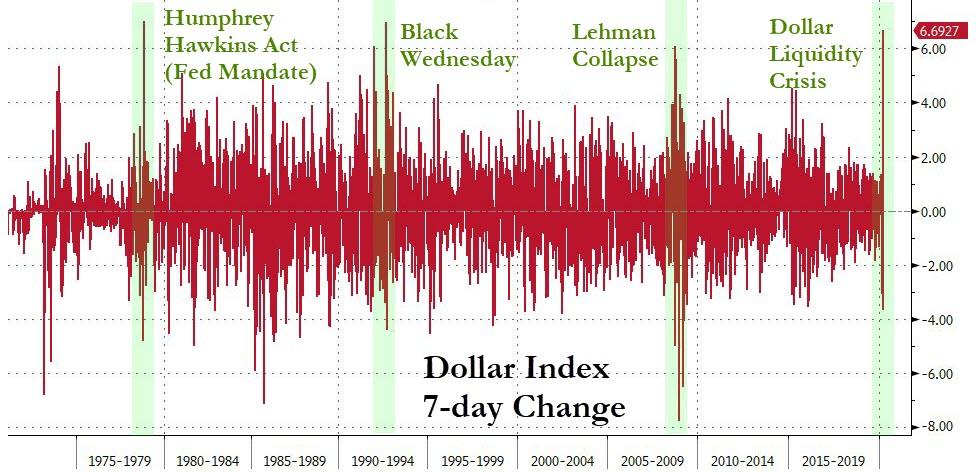

This is the biggest 7-day gain for the USDollar since Black Wednesday in 1992 when George Soros "broke The Bank of England," crashing the pound and forcing Britain to withdraw from the European Exchange Rate Mechanism.

It is also on par with October 1978's surge in the dollar when the Fed clamped down hard on monetary policy - after the signing of the Full Employment and Balanced Growth Act, better known as the Humphrey-Hawkins Act, mandating The Fed to crack down on inflation (which Volcker then did by drastically raising rates) - sending the stock market into the infamous "October massacre."

As a reminder, according to JPMorgan's calculations - the global dollar short that has doubled since the financial crisis and was $12 trillion as of this moment, some 60% of US GDP.

And, as we noted previously, the events of last week so ominously demonstrated, the dollar shortage is back with a vengeance, as confirmed by last week's concurrent surge in both the Bloomberg Dollar index and the FRA/OIS spread, a closely followed indicator of interbank dollar funding availability.

And it may come as a shock to some but ever since the financial crisis nothing has been actually fixed, and instead the Fed stepped in at every market stress event to inject more liquidity, aiding the issuance of even more debt, and kicking the can while while helping mask the symptoms of the crisis, only made the underlying financial instability even more acute. Meanwhile conventional wisdom that the US banking system was rendered more stable now are dead wrong, with the public and countless financial professionals fooled by the nearly two trillion in excess reserves (we all saw what happened when this number dropped to a precarious "low" of "only" $1.3 trillion in September of 2019) injected by the Fed in recent years. All this liquidity upon liquidity has only made the system that much more reliant on the Fed's constant bailouts and liquidity injections.

https://www.zerohedge.com/markets/wh...gin-call-looks

Banks Are Going To Drown In An Ocean Of Defaults

The entire world has completely ‘misunderestimated’ the Coronavirus...

www.zerohedge.com

BIG SNIP...

Even now, after one of the worst stock market crashes in history, people are still woefully underestimating the effects.

And I’m not talking about the stock market (though there could easily be more losses ahead). I’m talking about something far more serious: banks.

Banks are about to drown in an ocean of defaults. I’ll talk about this a lot more in the coming days, but briefly:

- There’s $250 TRILLION in global debt right now– mortgages, credit card debt, business loans, government debt, etc.

- And banks own a large portion of that debt.

- This virus crisis is going to trigger a wave of defaults from consumers, businesses, and even governments.

- Think about it: tourism alone makes up 10% of global GDP. Revenue in that entire sector– hotels, airlines, cruise ships, etc. has collapsed, and many of those companies aren’t going to survive.

- The crash in oil prices is going to wipe out countless oil companies.

- Many large retail chains, which were already struggling in the age of e-commerce, will likely declare bankruptcy.

- Countless businesses around the world have ‘temporarily’ closed due to public health policies, and many of them will go out of business entirely.

- MOST of these businesses owe lots of money to the banks, whether it’s a small business working line, or the $34 billion in debt that American Airlines owes. So the defaults are going to be massive.

- On top of that, millions of people are going to lose their jobs and be unable to make payments on their credit card debt, auto loans, and even mortgages.

- Again, there’s $250 trillion in global debt right now. Total bank capital worldwide is less than $10 trillion.

- So if the coming defaults trigger a mere 4% loss in total debt, it will exceed the entirety of global bank capital.

- And this doesn’t even take into consideration the impact of the $1 QUADRILLION derivatives exposure.

Misunderestimate? Absolutely.

This looming wave of loan defaults over the next few months could spark a crisis in the global financial system that completely dwarfs what happened back in 2008.

I desperately want to be wrong.

And it’s possible that public health officials radically shift their positions in the coming weeks and tell all the young, healthy people in the world to go back to work, get infected, and start developing immunity.

They may be forced to do this to avoid destroying the global economy.

But at this point, every possible scenario is on the table. Nothing is out of the question… especially when the arithmetic is so obvious.

And continuing to misunderestimate the effects of this virus could be far more dangerous than the virus itself.

We’ll talk about this more in the coming days, along with some sensible suggestions to reduce risk.

* * *nking system was rendered more stable now are dead wrong, with the public and countless financial professionals fooled by the nearly two trillion in excess reserves (we all saw what happened when this number dropped to a precarious "low" of "only" $1.3 trillion in September of 2019) injected by the Fed in recent years. All this liquidity upon liquidity has only made the system that much more reliant on the Fed's constant bailouts and liquidity injections.

Reply With Quote

Reply With Quote

Bookmarks