Saudi-Russia oil war collapses prices — and the US is in the middle

Michelle Lewis

- Mar. 9th 2020 9:32 am

127 Comments

Russia refused to cut oil output quotas by up to 1.5 million barrels per day at a failed meeting on Friday between OPEC and non-OPEC nations. So in retaliation, Saudi Arabia will produce 2 million barrels per day at $6 to $7 a barrel into an already oversupplied global market. As a result, oil prices have dropped by a third today.

How did this oil-price collapse happen?

Saudi Arabia wanted OPEC and Russia to make oil production cuts to support oil prices in light of the coronavirus outbreak, which has hurt the global economy. But Russia objected, saying everyone can produce whatever they want, so Saudi Arabia jacked up oil production to 2 million barrels per day and discounted its oil prices. Analysts say Saudi Arabia is punishing Russia for abandoning the two countries’ three-year supply pact. The oil market is already saturated.

Saudi Arabia plans to boost its crude output above 10 million barrels per day in April when the pact expires.

Where does the US come into this price war?

Officially, Russia said it wants to wait and see what the coronavirus’ impact is on the oil market before it makes a decision.

Unofficially, Russia is angry about US sanctions of Russian energy companies — the Trump administration imposed sanctions on Rosneft for transporting Venezuelan oil — and the US’ attempts to stop the Nord Stream 2 gas pipeline to Germany.

Russia felt that cutting output would boost the US shale industry, which has stolen customers away from Russia. So Russia sees this as an opportunity to put a dent in the US shale industry.

Russia says it can cope with low oil prices for six to 10 years.

What’s the outcome?

Oil prices dropped Monday by as much as one-third — the biggest loss since the 1991 Gulf War.

Keith Barnett, senior vice president strategic analysis at ARM Energy in Houston, says via Reuters:And as CNBC explains:

The timing of this lower price environment should be limited to a few months unless this whole virus impact on global market and consumer confidence triggers the next recession.

The industry is facing a three-sided attack: falling prices, a move of institutional investors to divest from fossil fuel companies, and crushing debt loads.FTC: We use income earning auto affiliate links. More.

The US oil and gas industry has about $86 billion of rated debt due in the next four years, according to Moody’s.

What everyone does seem to agree on is that the shale industry, its employees, and its remaining investors are going to experience very sharp pain in the near term.

Russia Says It Can Weather $25 Oil For Up To 10 Years

by Tyler Durden

Mon, 03/09/2020 - 09:14

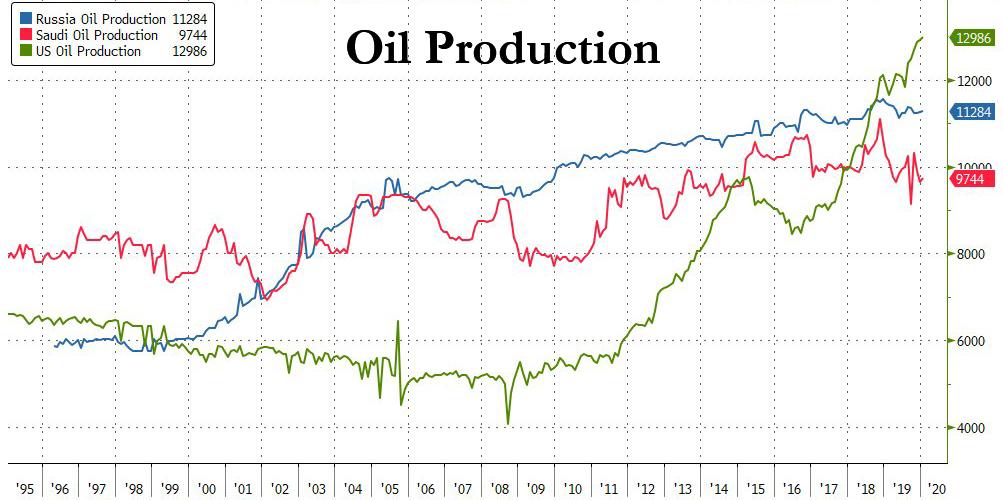

Now that both OPEC+ and OPEC no longer exist, and it's a free-for-all of "every oil producer for themselves" and which Goldman described as return to "the playbook of the New Oil Order, with low cost producers increasing supply from their spare capacity to force higher cost producers to reduce output", the key question is just how long can the world's three biggest producers - shale, Russia and Saudi Arabia...

... sustain a scorched-earth price war that keep oil prices around $30 (or even lower).

While we hope to get an answer on both Saudi and US shale longevity shortly, and once the market reprices shale junk bonds sharply lower, we expect the US shale patch to soon become a ghost town as money-losing US producers will not be solvent with oil below $30, assuring that millions in supply will soon be pulled from the market, moments ago we got the answer as far as Russia is concerned, when its Finance Ministry said on Monday that the country could weather oil prices of $25 to 30$ per barrel for between six and 10 years.

Iran's Oil Minister Wants OPEC+ Output Cut, Hopes for Russia Meeting Soon

The ministry said it could tap into the country’s National Wealth Fund to ensure macroeconomic stability if low oil prices linger. As of March 1, the fund held more than $150 billion or 9.2% of Russia’s growth domestic product.

Incidentally, this may explain why over the past two years, Putin has been busy dumping US Treasury and hoarding gold: he was saving liquidity for a rainy day, and as millions of shale workers are about to find out today, it's pouring.

https://www.zerohedge.com/energy/rus...5-oil-10-years

Reply With Quote

Reply With Quote

Bookmarks